Case Studies

Finance Transition for Carve Out Platform Acquisition

Virtas Partners was engaged by a private equity firm to assist with the stand-up of the finance organization for a platform acquisition that had been a corporate carve-out. Client Background The...

Carve-Out support for Public Company Divestiture

A $1.6 billion publicly listed solar technology company engaged Virtas Partners for assistance as it prepared for the divestiture of a non-core division. The company needed Virtas to prepare...

IPO Readiness for PE Portfolio Company

Virtas Partners was engaged by a private equity-owned infrastructure services company to assist with preparation for an IPO, including restatement of historical financial statements, preparation of...

Accounting Restatement, Interim CFO & Audit Preparation

Virtas Partners was engaged by a Private Equity-backed company to investigate historical accounting irregularities, transition the current CFO out of the company and prepare for the company's first...

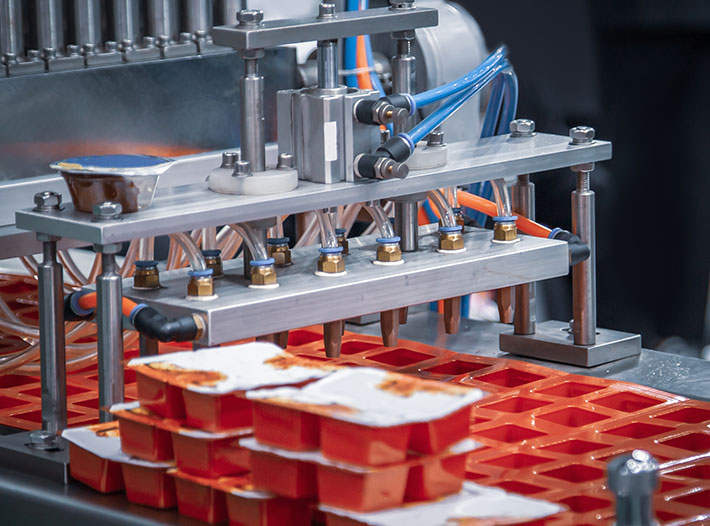

Acquisition Due Diligence & Finance Improvement for Food Packaging Company

Virtas Partners was engaged by a Private Equity firm to re-state historical financial information and analyze performance improvement opportunities at a $200M acquisition target. Client Background...

Quality of Earnings & Finance Transition for Logistics Brokerage

Virtas Partners was engaged by a Private Equity firm to support with evaluating a potential acquisition by performing a quality of earnings ("QoE") analysis and transition the finance function after...

Accounting Restatement & Process Improvement for Private Equity

Virtas Partners was engaged by a Private Equity firm to investigate irregularity in balance sheet accounts related Payroll & Benefits at one if its portfolio companies. Client Background Our...

Integration Management for Global Office of a Diversified Industrials Fortune 200 Company

Virtas Partners was engaged by a global manufacturing and distribution company focused on building controls and automation solutions (market cap over $30 billion) to stand up and lead its...

Performance Improvement / Capital Structure & Placement Drives Significant Growth in EBITDA

A wire and cable supplier engaged Virtas as financial advisor to improve the performance of the company, to drive EBITDA growth, to structure a credit facility in alignment with the business plan,...

Restructuring & Turnaround at Snack Foods Company

A failing "better-for-you" snack foods company turned to Virtas Partners for refinancing, restructuring, performance improvement and mentoring. The company needed its new advisor to succeed in a...